Share This Article:

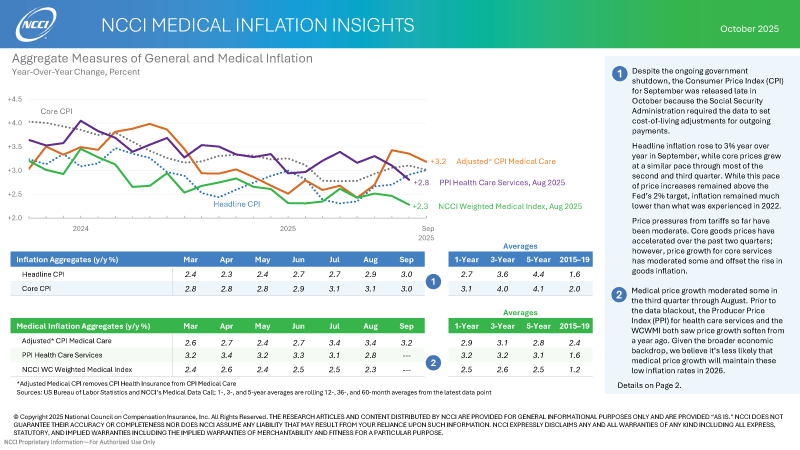

Key Insights: Aggregate Measures of General and Medical Inflation

- Despite the ongoing government shutdown, the Consumer Price Index (CPI) for September was released late in October because the Social Security Administration required the data to set cost-of-living adjustments for outgoing payments.

- Headline inflation rose to 3% year over year in September, while core prices grew at a similar pace through most of the second and third quarter. While this pace of price increases remained above the Fed’s 2% target, inflation remained much lower than what was experienced in 2022.

- Price pressures from tariffs so far have been moderate. Core goods prices have accelerated over the past two quarters; however, price growth for core services has moderated some and offset the rise in goods inflation.

- Medical price growth moderated some in the third quarter through August. Prior to the data blackout, the Producer Price Index (PPI) for health care services and the WCWMI both saw price growth soften from a year ago. Given the broader economic backdrop, we believe it’s less likely that medical price growth will maintain these low inflation rates in 2026.

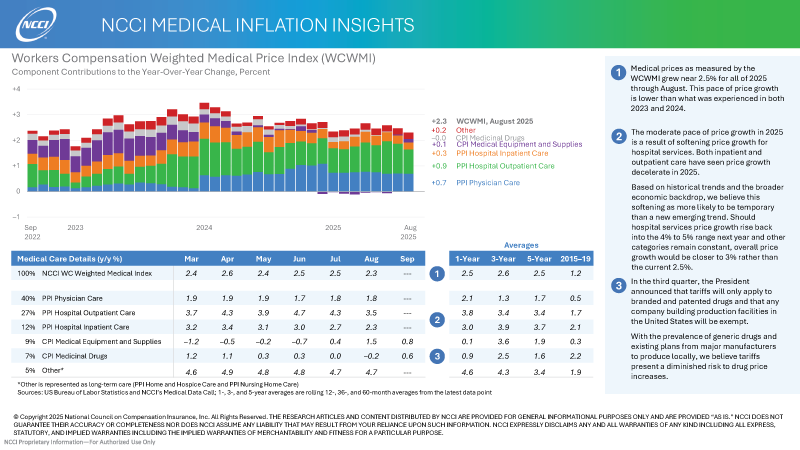

Key Insights: NCCI's Workers Compensation Weighted Medical Price Index (WCWMI)

- Medical prices as measured by the WCWMI grew near 2.5% for all of 2025 through August. This pace of price growth is lower than what was experienced in both 2023 and 2024.

- The moderate pace of price growth in 2025 is a result of softening price growth for hospital services. Both inpatient and outpatient care have seen price growth decelerate in 2025. Based on historical trends and the broader economic backdrop, we believe this softening as more likely to be temporary than a new emerging trend. Should hospital services price growth rise back into the 4% to 5% range next year and other categories remain constant, overall price growth would be closer to 3% rather than the current 2.5%.

- In the third quarter, the President announced that tariffs will only apply to branded and patented drugs and that any company building production facilities in the United States will be exempt.

With the prevalence of generic drugs and existing plans from major manufacturers to produce locally, we believe tariffs present a diminished risk to drug price increases.

Click the images to access the Medical Inflation Insights report, and click here for a history of the data available from the prior report. Due to the ongoing government shutdown, the data spreadsheet will not be updated at this time. Updates will resume once the shutdown concludes.

AI california case file caselaw case management case management focus claims compensability compliance compliance corner courts covid do you know the rule employers exclusive remedy florida glossary check Healthcare hr homeroom insurance insurers iowa leadership medical NCCI new jersey new york ohio pennsylvania roadmap Safety safety at work state info tech technology violence WDYT west virginia what do you think women's history women's history month workers' comp 101 workers' recovery Workplace Safety Workplace Violence

Read Also

- Feb 26, 2026

- NCCI

- Feb 21, 2026

- Dennis Sponer

About The Author

About The Author

- NCCI

Read More

- Feb 26, 2026

- NCCI

- Feb 21, 2026

- Dennis Sponer

- Feb 19, 2026

- NCCI

- Feb 16, 2026

- Dennis Sponer

- Feb 14, 2026

- Amanda Conley Lauren Meadows

- Feb 13, 2026

- NCCI