Share This Article:

Worker Outcomes, Opioid Reductions, and Prices for Drugs and Hospitals

17 Jun, 2019 WorkersCompensation.com

It’s Research Roundup time.

Here’s my quick takeaways on new research – and how it affects you.

WCRI on the interaction of health insurance and workers’ comp

Bogdan Savych PhD of WCRI has provided an excellent review of the interaction of health insurance coverage and workers’ outcomes post-injury.

The percentage of workers with health insurance increased from 84% in 2008 to 90% in 2017, driven primarily by the ACA. Notably Medicaid expansion was responsible for most of this growth. Overall, workers who had private health insurance:

- got an initial non-ER evaluation a little earlier;

- recovered a little faster;

- were more likely to return to work; and

- were a bit less likely to hire an attorney.

Note these differences were slight – but real – for workers who had employer-based coverage, NOT Medicaid. (Dr Savych separated out workers covered by these two payers.)

This means – health insurance coverage slightly improves work comp outcomes.

Implementation of the ODG formulary and opioid reduction

NCCI’s just-released analysis shows minimal correlation between adoption of the ODG formulary and decreased opioid dispensing. From the report:

The ODG Formulary had a limited observed impact on opioid utilization in the early period after implementation.

It appears other factors such as much more public and prescriber awareness of the dangers of opioids and general changes in prescribing patterns may have been a primary driver of the across-the-board decrease in opioid scripts.

This means…formularies are a relatively small part of the solution. Strong UR and external factors are likely much more important.

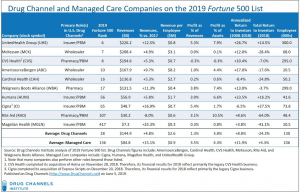

Drug prices and profits

Adam Fein’s excellent Drug Channels delivers details on where the pharmacy profits are piling up.

Dr Fein notes “many multi-billion-dollar businesses profit as drugs move through the U.S. reimbursement and distribution system.”

This means…most rebate dollars are passed thru to employers and PBMs.

Hospital prices

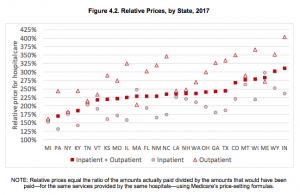

RAND’s research finds the gap between Medicare reimbursement for facility services and what other private health plans pay increased over the last few years; on average private insurers paid almost 2 1/2 times Medicare rates.

This varied widely among states; if you operate in Colorado, Montana, Wisconsin, Maine, Wyoming, and Indiana reimbursement is even higher, while Michigan, Pennsylvania, New York, and Kentucky’s commercial prices were only 1.5 to 2 times Medicare rates (yippee…).

This means…work comp payers are almost certainly paying way too much for hospital care.

By Joe Paduda

Courtesy of Managed Care Matters

Read Also

- Jul 01, 2024

- Frank Ferreri

- Oct 19, 2023

- Bill Zachry

About The Author

About The Author

- WorkersCompensation.com

More by This Author

- Jun 24, 2024

- WorkersCompensation.com

- May 11, 2023

- WorkersCompensation.com

- May 10, 2023

- WorkersCompensation.com

Read More

- Jul 01, 2024

- Frank Ferreri

- Oct 19, 2023

- Bill Zachry

- Oct 12, 2023

- Liz Carey

- Sep 28, 2023

- F.J. Thomas

- Sep 28, 2023

- WorkersCompensation.com

- Sep 15, 2023

- Chris Parker