Share This Article:

There’s a lot of bleating about the huge profits made by health insurers, with some – including too many who should know better – complaining loud and long. [Insurers and pharma netted about $97 billion last year.]

While some would argue the billions raked in by insurers is far too much, let’s take a step back and look at the big picture.

First, insurers’ profits are a tiny fraction of our $3.6 trillion healthcare spend – as in >1 percent.

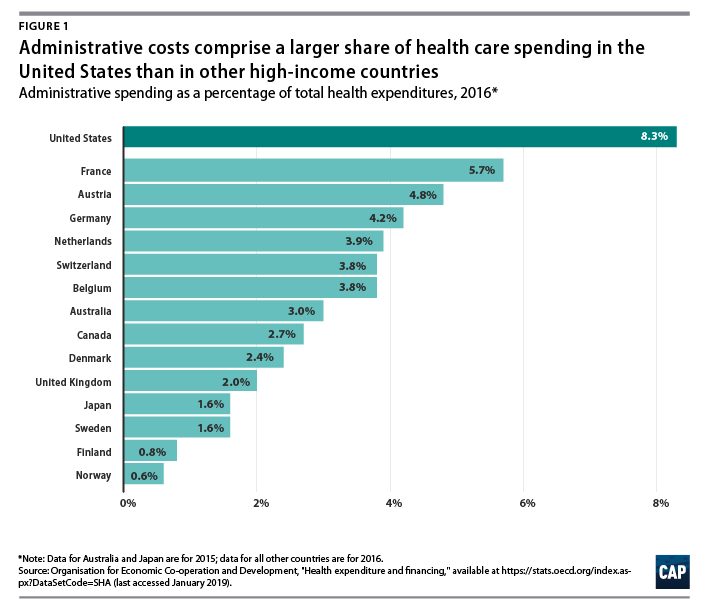

Second, healthplan, insurers, and other payers’ total administrative expenses amount to 8.3% of that $3.6 trillion – roughly $300 billion.

Oh, and a big chunk of most health insurers’ business comes from servicing governmental programs. Example – 58% of United Healthcare’s revenue is from Medicare, Medicaid, and other governmental programs.

Frankly, given commercial insurers’ demonstrated inability to control costs and improve quality, that $30 billion may be too generous by far. But it’s clear the big problem with healthcare costs is not insurer profits or administrative expense.

It’s the underlying prices of healthcare.

What does this mean for you?

It’s not insurer profits.

By Joe Paduda

Courtesy of Managed Care Matters

Read Also

- Jul 01, 2024

- Frank Ferreri

- Oct 19, 2023

- Bill Zachry

About The Author

About The Author

- WorkersCompensation.com

More by This Author

- Jun 24, 2024

- WorkersCompensation.com

- May 11, 2023

- WorkersCompensation.com

- May 10, 2023

- WorkersCompensation.com

Read More

- Jul 01, 2024

- Frank Ferreri

- Oct 19, 2023

- Bill Zachry

- Oct 12, 2023

- Liz Carey

- Sep 28, 2023

- F.J. Thomas

- Sep 28, 2023

- WorkersCompensation.com

- Sep 15, 2023

- Chris Parker