Share This Article:

Medicare Secondary Payer compliance plays an integral part in every workers’ compensation claim management team’s processes. In order to run an effective claim team, everyone must be aware of these changes, legislation that could become law, and understand how it impacts their processes and procedures.

Changes to the Work Comp MSA Review Process

The Workers’ Compensation Medicare Set-aside (WCMSA) Reference Guide maintains all matters Medicare Secondary Payer compliance. It governs the voluntary review and approval process and contains policy interpretations of the Centers for Medicare and Medicaid Services (CMS). Over the last two years, several changes have impacted the review and approval process. These changes included:

- Updates to the CMS Consent to Release authorization. This release is required to be executed by the beneficiary/employee and contains a required attestation when the parties are having a Medicare Set-aside reviewed; and

- Changes to the Re-Review and Amended Review process. While there is no formal appeals process for reviewing a Medicare Set-aside, parties can re-submit the approved allocation for a second look under certain circumstances.

On April 19, CMS updated the WCMSA reference guide and published version 3.3. Significant changes that took immediate effect include:

- Section 5.2 – Structured Settlements and Seed Money: CMS provided clarification on the calculation of seed money for an annuity. It is now indicated that the seed money should include “the first surgery or procedure for each body part, and/or replacement and the first two years of annual payments.”

- Section 9.4.5 – Pricing: include refills when pricing intrathecal pumps: CMS added a section on how they want these pumps allocated.

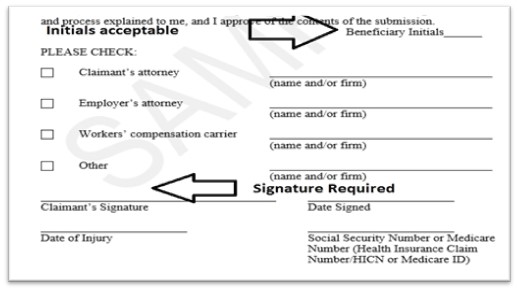

- Section 10.2 – CMS Consent to Release: There is added verbiage that the CMS Consent to Release needs to be signed, not initialed by the Claimant/Employee. A review of the changes found on page 48 (Figure 10-1: Blank Consent to Release Note) indicates this does not apply to the attestation portion toward the top third for the “Beneficiary Initials.”

- Section 10.3 – Updated Life Expectancy Chart: CMS now requests that allocations be based upon the newly released life expectancy table – https://www.cdc.gov/nchs/data/nvsr/nvsr69/nvsr69-12-508.pdf

- Section 16.2 – Amended Review and Professional Administration: Under the CMS Amended Review process, submitters will need to provide CMS with information regarding professional administrators who were not the original administrator under Section 19.4 (Change in Submitter). Professional Administrators whose EIN does not match the EIN of the original submitter contact BCRC to gain access to the case via the WCMSA Portal; otherwise, you must submit by mail.

- Appendix 7-1: The Major Medical Centers table was updated for a Missouri entry.

All interested stakeholders should take note of these changes and determine how it impacts their claims practices.

Medicare Set-aside Legislation Introduced on Congress

Sen. Rob Portman recently introduced the Coordination of Medicare Payments and Workers’ Compensation Act - COMP Act (S. 653). The bill amends the Medicare Secondary Payer Act to address various Workers’ Compensation Medicare Set-Aside (WCMSA) processes and change the landscape of effective compliance if passed into law.

There are several exciting highlights in this bill. They include:

- Codifying standard terms such as Compromise Agreement, Workers’ Compensation Claimant, Workers’ Compensation Law or Plan, Workers’ Compensation Payer, Medicare Set-aside; Medicare Set-aside Amount, and what constitutes a workers’ compensation plan. If this bill becomes law, it will apply to all state and federal workers’ compensation programs. Nothing under this bill applies to non-workers’ compensation cases or settlements.

- Creation of a Qualified Medicare Set-aside that includes the opportunity for parties upon agreement to adopt a “proportional adjustment of the set-aside amount” and other mechanisms in the voluntary review and approval process to ensure legal, safe harbors from future adverse CMS legal action. Any reduction of a Medicare Set-aside would be based on the “[T]he percentage … equal to the denied, disputed, or contested percentage of such total settlement;”

- Full legal recognition of state law and rules such as a statute of limitation provisions found in Georgia, Montana, and Wisconsin; and

- Creating an MSA appeals process with a formal pathway to appeal an adverse CMS decision on an MSA allocation into federal courts.

The pathway to this bill become law is unclear and uncertain given the past inaction by Congress. If passed, the bill would benefit all parties in the workers’ compensation process and encourage settlement.

Read Also

About The Author

About The Author

- Rebecca Shafer

More by This Author

Read More

- Oct 19, 2023

- Bill Zachry

- Oct 12, 2023

- Liz Carey

- Sep 28, 2023

- F.J. Thomas

- Sep 28, 2023

- WorkersCompensation.com

- Sep 15, 2023

- Chris Parker